Related Articles

Subscribe to the Greater Public newsletter to stay updated.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

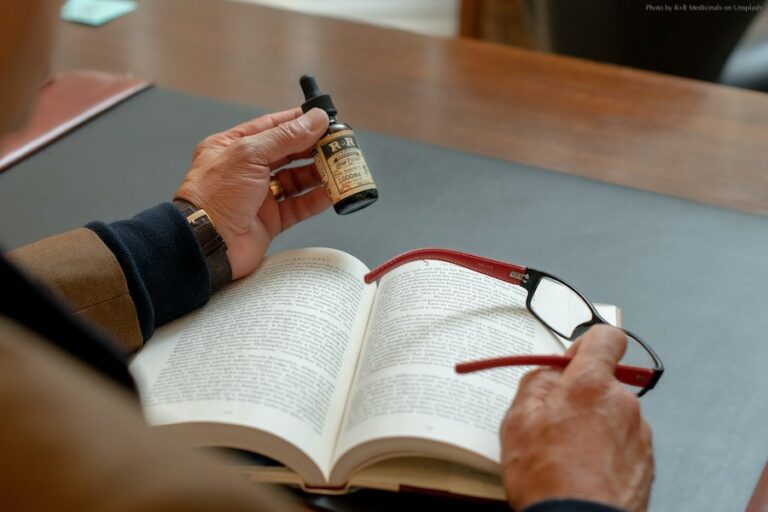

Since the Farm Bill legislation last year (which changed the legal status of hemp, therefore making certain types of CBD products legal), there has been increased discussion about what this means for public media underwriting.

In the past, the FCC has generally warned stations not to advertise or accept underwriting for “illegal” products and underwriting messages are protected by the First Amendment only if related to “lawful activity.”

But now that some CBD non-food products derived from low-THC industrial hemp (.3% or lower) are legal under federal law, it could follow that stations interested in accepting underwriting from companies with CBD products would face significantly lower risk.

That said, stations should still proceed with caution.

Here are some tips to consider as your station weighs the risk associated with this opportunity:

Thanks to Lesli Blount, VPR for contributions to this blog post, as well as takeaways from this article and related webinar.

New to Greater Public? Create an account.