Related Articles

Subscribe to the Greater Public newsletter to stay updated.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Original data presented by Karen Hopper, senior data strategist, M+R.

Each year, the online marketing and PR group M+R conducts Benchmarks, a study of 154 nonprofits focused on their online strategy and performance. This year’s findings about calendar-year-end giving were particularly illuminating.

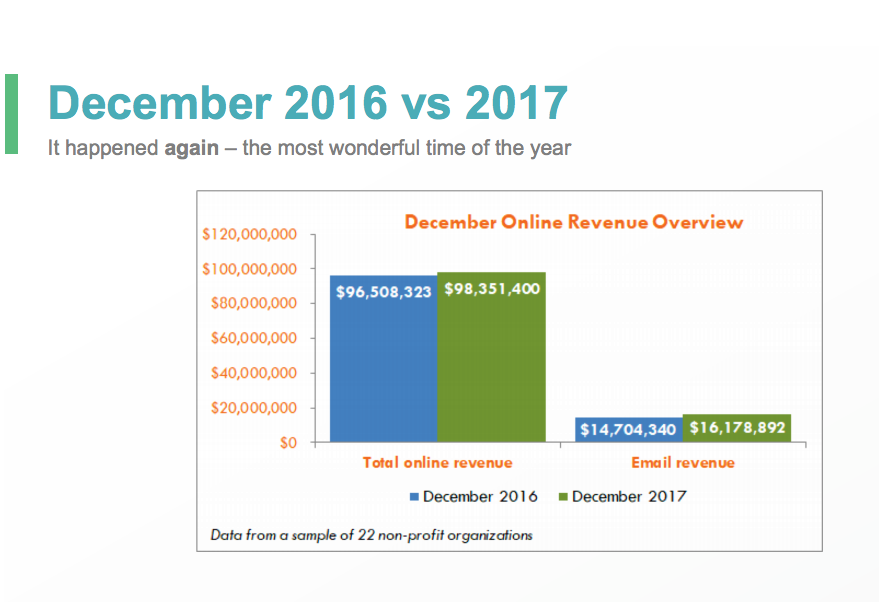

First, M + R wanted to know how much December giving would fluctuate from 2016 to 2017, since many organizations experienced a significant bump in year-end giving revenue after the 2016 election.

For the 22 organizations for which M+R has year-over-year data, most saw a 12% increase in year-end giving over that of 2016, which was the same increase as the year before (from 2015 to 2016). But the growth wasn’t evenly distributed. The nonprofits that became or remained very political after the 2016 election experienced an exceptionally high giving increase that year. Those organizations had a harder time sustaining their giving increase in 2017. These groups actually saw an average 3% decline in end-of-year revenue from 2016.

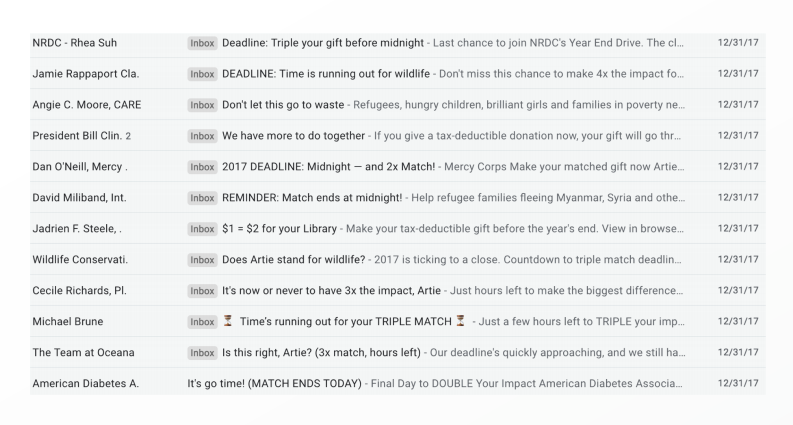

Behold: the typical inbox on December 31 of someone who belongs to a lot of email lists:

Notice the prevalence of deadline messaging! Organizations continue to lean on last-chance messaging, and it works. 23% of all December, 2017 revenue came in on December 31. In 2016, 22% of all December revenue came in on December 31.

M+R’s client group sample-sent an average of 11 email fundraising appeals in December 2017; that’s one more than in 2016. Their email list size (or at least the number of people receiving email) was slightly down, and the median organization was emailing slightly fewer subscribers (-1%). Some groups cut their deliverable files by up to 50% as part of an aggressive inactive suppression strategy. This strategy is aimed at identifying “dead weight” on email files: users who do not open or click on emails for a set period of time, which can trigger spam filters on large email providers like Gmail and Yahoo.

The aggressive suppression strategy seems to be paying off because even with the extra messages and slightly lower audience sizes…

This all adds up to a 13% increase in revenue directly attributed to email.

A greater number of organizations are investing in paid ads, including 25 out of 31 organizations that participated in the M+R year-end study. The average group reported a 140% ROI on their ad spend. 16% of all December revenue was attributed directly to ads via last click in 2017, a big jump from the 5% seen in 2016.

Some organizations express hesitation at the “creepiness factor” of ads that follow users around. The reality is: these ads work.

Here are the most essential point you won’t want to forget for 2018 year-end:

Onward to December!

New to Greater Public? Create an account.