Benchmarks is a diagnostic assessment that reveals your station’s financial potential and how your fundraising programs are performing in relation to that potential. Benchmarks takes the guesswork out of fundraising, paving the way for precise, evidence-based planning. And it’s free and accessible to all Greater Public member stations.

Here’s how it works. You cull data about your fundraising. Greater Public contextualizes your data, showing you the relationship between the size of your listening audience and your fundraising performance based on information provided by the Radio Research Consortium and Nielsen. You receive two customized reports: One that tracks your fundraising performance over as many as five years, and another that shows how your station stacks up against your peers, revealing your station’s full fundraising potential.

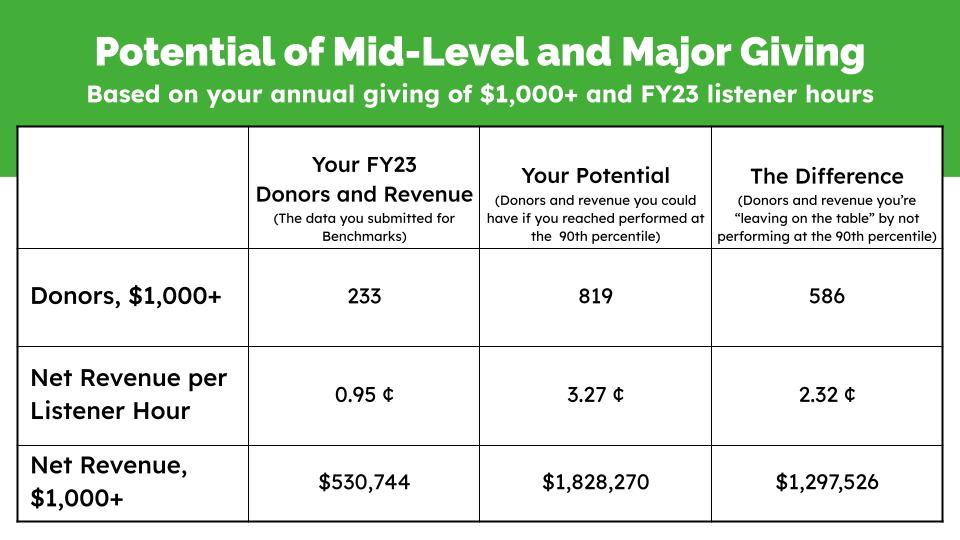

Benchmarks will tell you quantitatively how many members you could have based on your total listenership. You’ll know how much money you could be raising in corporate support, membership, mid-level giving, and major giving. Major giving is important because it’s the biggest growth segment in public media right now.

Jay Clayton is an individual giving advisor with Greater Public. He’s seen first hand how Benchmarks can help stations. “The cool thing about public radio is that our fundraising potential can be calculated,” says Clayton. “That’s because our fundraising potential is our audience. Nielsen measures it and the Radio Research Consortium provides it to stations on a regular basis. I can’t think of another non-profit sector where this happens, and it’s a huge plus for us as long as we take advantage of it.”

Stations say they rely on Benchmarks to help them understand their own fundraising in the context of industry trends and what those trends are.

“Many stations have told us they’d be lost without Benchmarks,” says Clayton. “Radio listening has undergone seismic changes over the past few years, and those changes have had a profound effect on stations’ fundraising potential. Participating in Benchmarks helps stations understand how changes in listening can impact fundraising performance and expectations. This puts station leaders in a strong position to make smart, informed choices.”

This shows the value of Benchmarks even for public media organizations that are major, established players. Seeing industry-wide trends through the lens of Benchmarks data provides assurance in knowing that other stations are facing similar challenges.