Related Articles

Subscribe to the Greater Public newsletter to stay updated.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Public radio and TV corporate support departments learned a lot from the pandemic in 2020. It revealed to us that focusing too much on business categories like performing arts and retail can put station revenue at risk when faced with a disruption. We also know from past experience that a recession places strain on retail, restaurants, and real estate.

It’s important to mitigate risk in corporate support account lists by working a good spread of business categories. It’s also important to include and focus on categories that are resilient during recessions. Many corporate support account managers have worked hard to increase the mix of business categories in their account lists over the last two years.

Now it’s more important than ever to continue the work of building a strong mix of stable and resilient business categories in your corporate support account list. Here is some research to help you focus your work on strong public media business categories for a successful 2023.

Below is the BIA Advisory Service’s top recession-proof business opportunities for 2023. This is from Inside Radio‘s December 19th’s email. It aligns with the best business categories for public media.

Projected ad spend in 2023: $1.7 billion

Nearly a third of ad dollars (31.4% or $522 million) in this category are earmarked for digital advertising. Direct mail will get the largest share of wallet (29.4%), followed by over-the-air TV (15.0%), out-of-home (11.5%) and PC/laptop (9.4%).

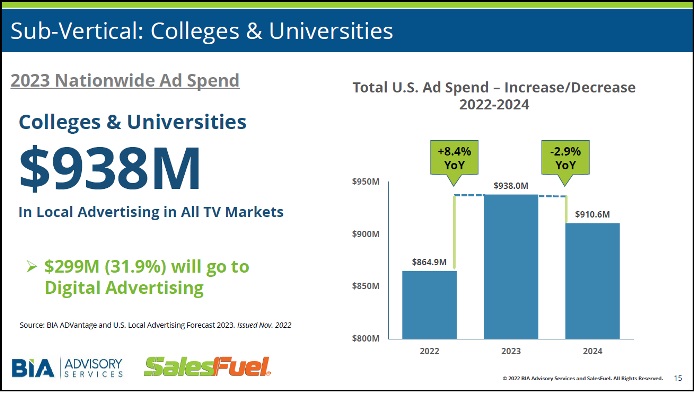

The colleges and universities sub-vertical is expected to spend $938 million in 2023, an 8.4% year-over year increase, with roughly one-third going to digital advertising.

Key trends:

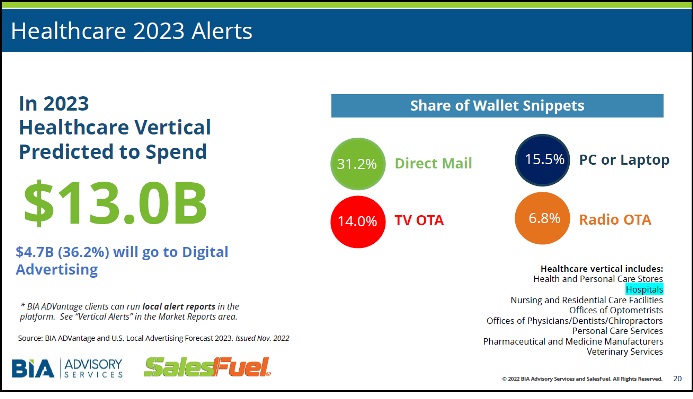

Projected ad spend in 2023: $13.0 billion

Digital advertising will cordon off one-third (32.6%) of next year’s budget, while over-the-air radio will get about 6.8%. The hospitals sub-vertical is on track to invest $4.76 billion next year, up 10.5% year-over-year, with 38.9% going to digital.

“Nearly four in ten (39%) of healthcare services patients say that they already have a [provider] in mind,” says SalesFuel’s Smith. “That’s where traditional advertising and other forms of digital marketing then come into play.”

Key trends:

Projected ad spend in 2023: $24.9 billion

Just over half (50.7%) will go to digital advertising. Direct mail will get the biggest piece (25.8%) while over-the-air radio is in line for 9.5%.

The auto and direct property insurance sub-category is poised to spend $5.15 billion next year, up 13.9% year-over-year. More than half (51.2%) will go to digital advertising.

Key Trends:

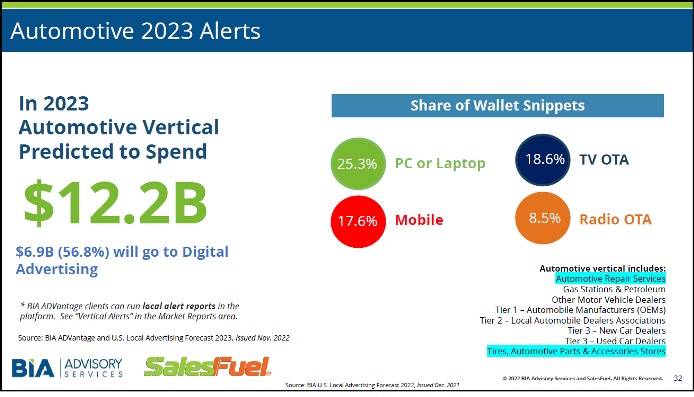

Projected ad spend in 2023: $12.2 billion

More than half (56.8%) of these dollars are going to digital advertising. “It’s definitely been a rough two years for auto dealerships,” says Smith. “You’ve had COVID, inventory shortages, and now high interest rates.” With the average vehicle on the road now over 12 years old, the hottest sub-vertical in this broad category is auto repair.

Key trends:

Projected ad spend in 2023: $12.4 billion

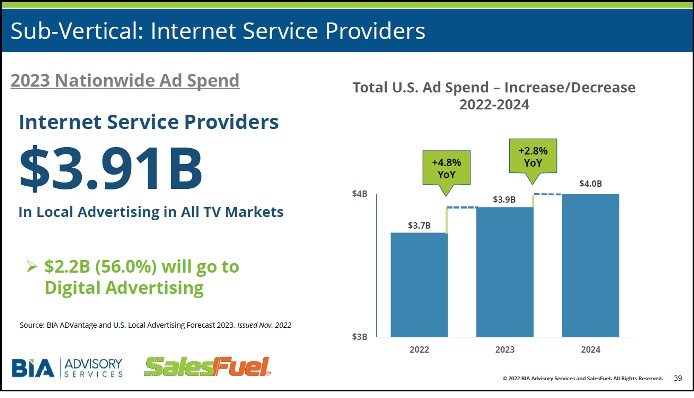

As you might expect, the lion’s share (61.4%) is destined for digital advertising. The internet service provider sub-category will invest $3.91 billion in local advertising, up 4.8% more than in 2021.

Key trends:

Stay vigilant and build a resilient corporate support account list in 2023 by working categories that may take a little longer to close, but will renew and stay as a corporate supporter longer. You will be glad you did and find your account list more resilient to pandemics and recessions, Happy New Year!

View these related member resources and more with a Greater Public membership:

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

New to Greater Public? Create an account.